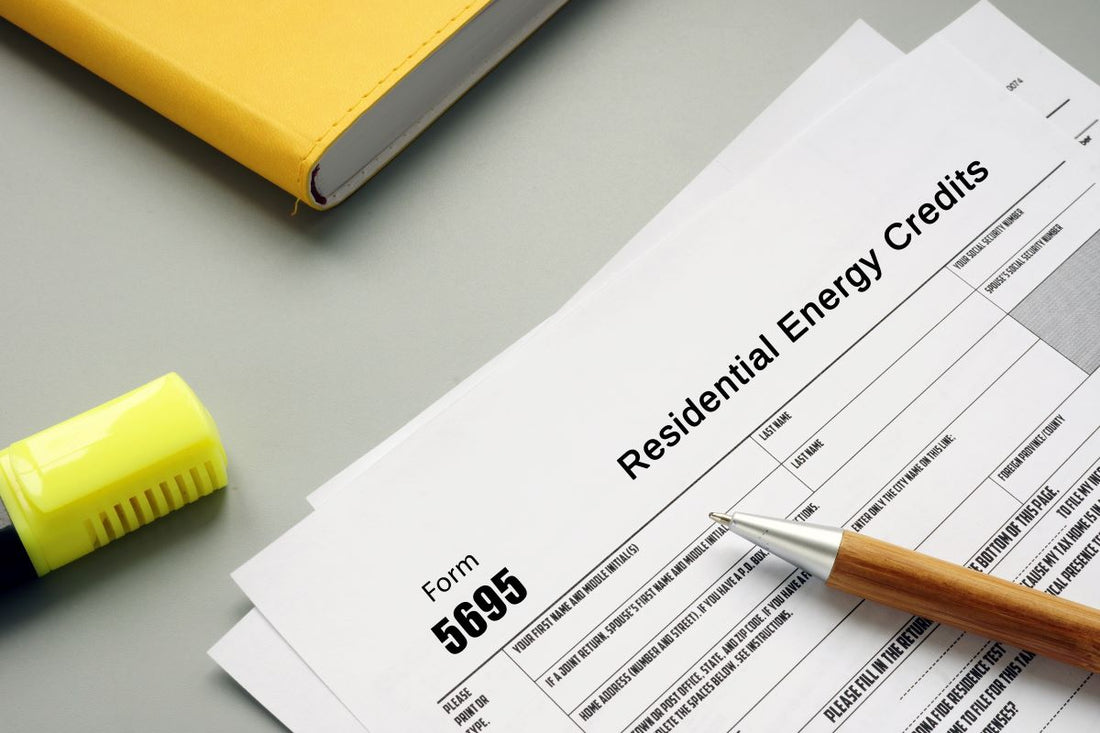

Home Improvement Deduction 2024 Irs – The energy efficient home improvement credit can help homeowners cover up to 30% of costs related to qualifying improvements made from 2023 to 2032 . The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for .

Home Improvement Deduction 2024 Irs

Source : www.section179.orgIRS releases guidance on PIN requirement for energy efficiency

Source : kha.cpaWealth Planner Luke Neumann, CFP®, Discusses IRS Home Improvement

Source : www.crestwoodadvisors.comEnergy Efficiency Home Improvement Credit 2024: How to Qualify

Source : www.ecofoil.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comAime & Co. Tax Services | Linden NJ

Source : m.facebook.comTXCPA Houston News | Resources for CPAs

Source : www.tx.cpaIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comIRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comHome Improvement Deduction 2024 Irs Section 179 Deduction – Section179.Org: With a tax credit, 2023 and 2024 home improvements are way more attractive Photo: istockphoto.com Although some tax deductions and credits already were in place for home improvement and energy . Wondering which tax breaks you might be able to take advantage of this year? It might help to first take stock of any major financial decisions or changes you made last year. Home upgrades, a new .

]]>

.png?sfvrsn=d466a8b1_2)

.png)